Updated on Feb. 17 2026

Current Supported Elements

This section explains all elements available when building and testing strategies on CoinQuant.

Supported Assets

CoinQuant supports a curated set of assets for strategy backtesting and trading.

You can find supported assets in the Asset dropdown within the backtest configuration.

Supported Crypto Assets:

Supported Commodities/Other Assets:

Supported Timeframes:

Order Types

1. Market Order

Executes immediately at the best available market price.

Best used when entering or exiting a trade quickly is more important than price precision.

Key Details:

- Instrument – the asset being traded

- Side – Buy or Sell

- Quantity – amount to trade

- Order Duration (optional) – how long the order remains active

- Tag (optional) – label for tracking or categorization

Example:

“Buy 1 BTC at market now.”

2. Limit Order

Places an order at a specific price and executes only if the market reaches that price.

Best used when you want control over the exact execution price.

Key Details:

- Instrument – the asset being traded

- Side – Buy or Sell

- Quantity – amount to trade

- Limit Price – the exact price you want to buy or sell at

- Order Duration – how long the order remains active

- Post Only (optional) – ensures the order adds liquidity

- Reduce Only (optional) – ensures the order only reduces an existing position

- Tag (optional)

Example:

“Place a buy limit for 5 ETH at 1,500 and keep it GTC.”

3. Stop-Market Order

Triggers a market order once a specified price level is reached.

Commonly used for stop-losses where guaranteed execution matters more than price.

Key Details:

- Instrument, Side, Quantity

- Stop Price – price that activates the order

- Trigger Source – Last / Bid / Ask / Mark

- Order Duration, Reduce Only, Tag (optional)

Example:

“If BTC drops to 30,000, sell 1 BTC at market.”

4. Stop-Limit Order

Triggers a limit order when the stop price is reached.

Provides price control but execution is not guaranteed.

Key Details:

- Instrument, Side, Quantity

- Stop Price – activates the order

- Limit Price – price of the resulting limit order

- Trigger Source, Order Duration

- Post Only, Reduce Only, Tag (optional)

Example:

“If BTC hits 30,000, place a sell limit at 29,950.”

5. Market To Limit (MTL)

Executes immediately as a market order, then converts any unfilled portion into a limit order at the price of the initial execution.

Best used when fast execution is needed without unwanted price exposure.

Key Details:

- Instrument – the asset being traded

- Side – Buy or Sell

- Quantity – amount to trade

- Order Duration – how long the resulting limit order remains active

- Post Only(optional) – applies to the limit portion only

- Reduce Only(optional) – ensures the order only reduces an existing position

- Tag(optional) – label for tracking or categorization

Example:

“Buy 10 SOL using market to limit; execute immediately and leave the remainder as a limit order.”

6. Limit If Touched (LIT)

Triggers a limit order once a specified price level is reached.

Used when precise entries or exits are required.

Key Details:

- Instrument, Side, Quantity

- Trigger Price, Limit Price

- Order Duration

- Post Only, Reduce Only, Tag (optional)

Example:

“If BTC reaches 30,150, place a buy limit at 30,100 until noon UTC.”

Operators (Entry & Exit Logic)

Operators define how conditions are evaluated and when they trigger.

Supported Operators

- Crosses Above – triggers only at the moment one value moves from below to above another

- Crosses Below – triggers only at the moment one value moves from above to below another

- Above – condition stays true while the value remains above another

- Below – condition stays true while the value remains below another

- Less Than – triggers when a value is lower than a defined level

- Greater Than – triggers when a value is higher than a defined level

- Take Profit (Percentage) – exits a trade once a target profit percentage is reached

- Stop Loss (Percentage) – exits a trade once a maximum loss percentage is reached

- Stop Loss (Indicator) – exits a trade when a condition defined by an indicator signals a stop-loss

- Take Profit (Indicator) – exits a trade when a condition defined by an indicator signals a take-profit

Examples:

- “RSI crosses above 30”

- “Price is above the 50-day EMA”

- “Take profit at 5%, stop loss at 3%”

Supported Price Types

Defines which part of the candle is used for calculations.

- Close – last traded price of the candle

- Open – first traded price of the candle

- High – highest price during the candle

- Low – lowest price during the candle

- Mid (High + Low) / 2 – midpoint of the candle range

- Typical (High + Low + Close) / 3 – balances extremes with closing price

- OHLC Average (Open + High + Low + Close) / 4 – full candle average

Example:

“Use Typical price for Bollinger Bands.”

Supported Actions

Actions define what the strategy does when a condition is met.

- Buy – places a buy order using the selected order type

- Sell – places a sell order using the selected order type

- Enter Long – opens a long position

- Enter Short – opens a short position

- Exit Long – closes an existing long position

- Exit Short – closes an existing short position

Example:

“When MACD crosses above Signal, enter long. When RSI is above 70, exit long.”

Supported Indicators

CoinQuant supports over 36 technical indicators, grouped into intuitive categories.Each indicator explains what it measures, when it is useful, and how it is typically applied.

1. Trend Indicators

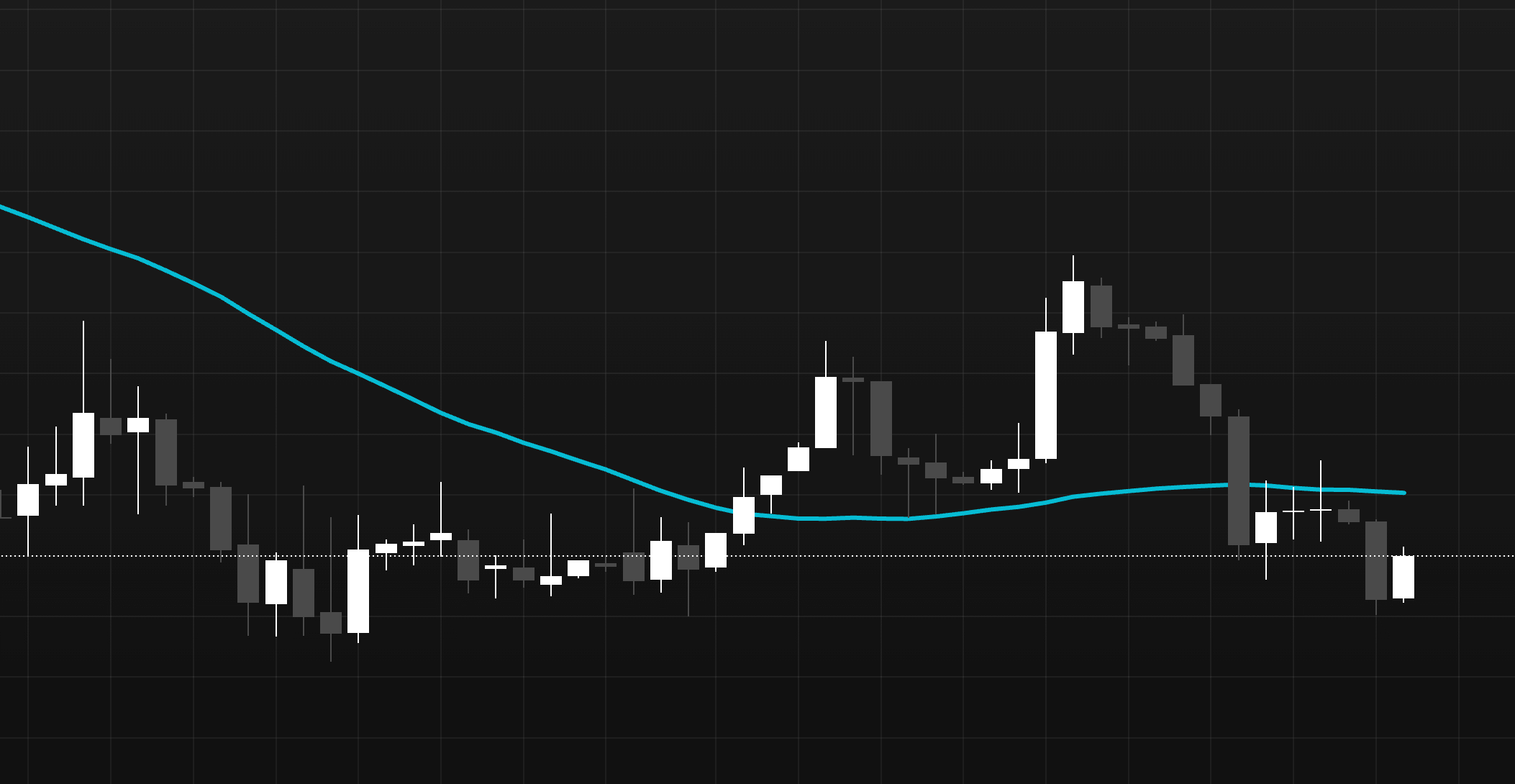

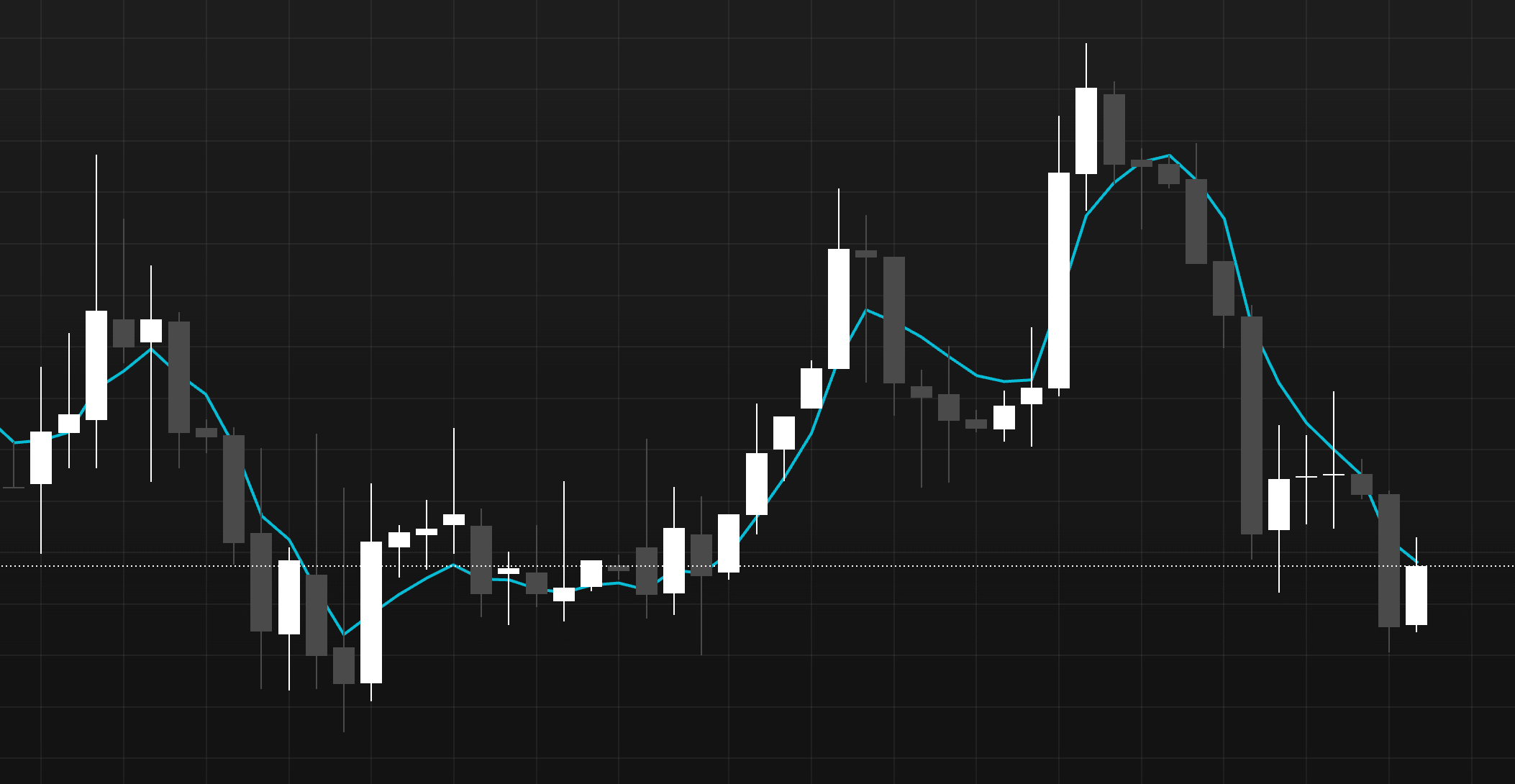

SMA – Simple Moving Average

A basic average of price over a fixed period.

- What it measures: Overall trend direction

- When to use it: Identifying long-term or stable trends

- Why it’s useful: Simple, reliable benchmark for trend analysis

- Default Period: 9

Example:

“Buy when price crosses above the 50-period SMA.”

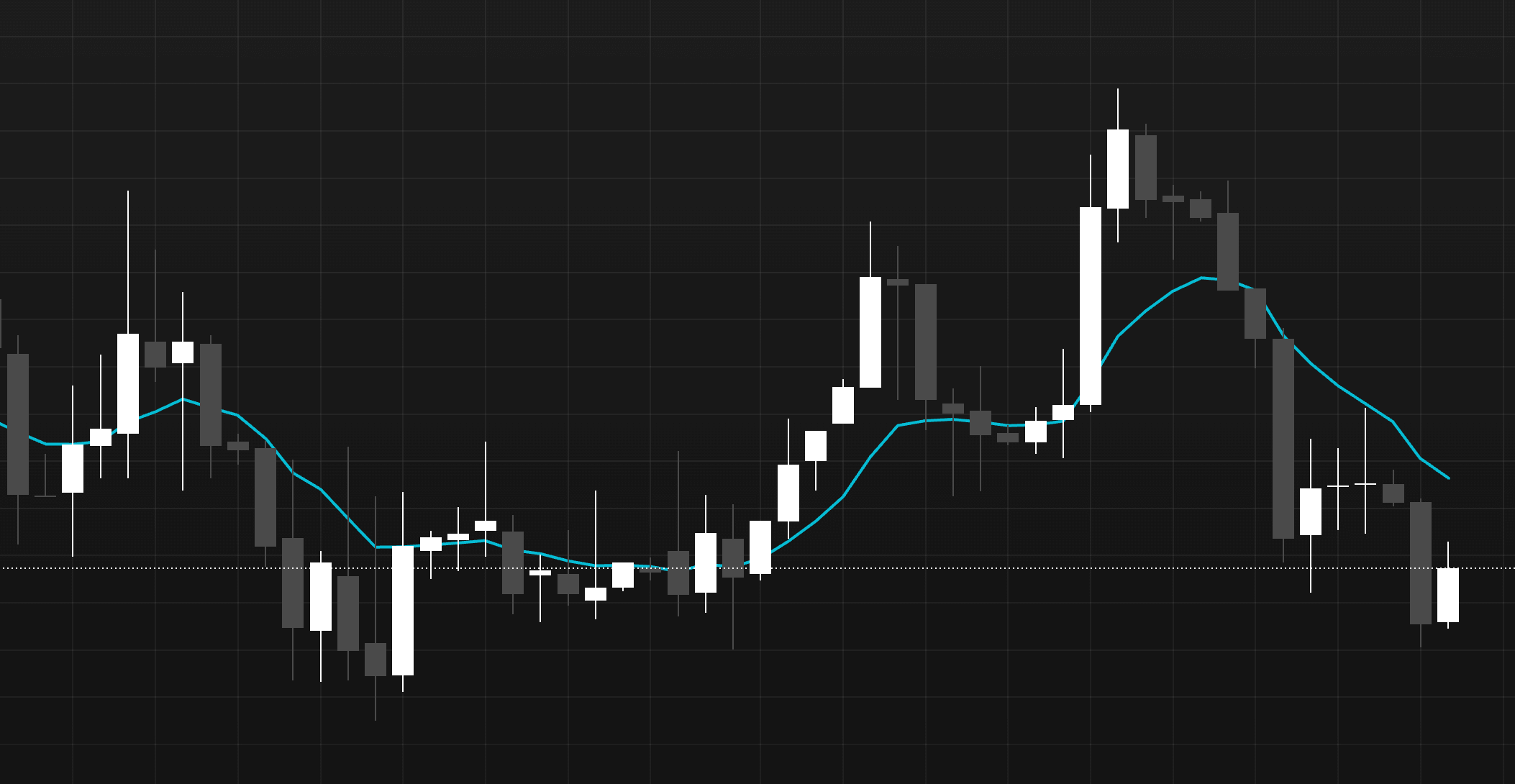

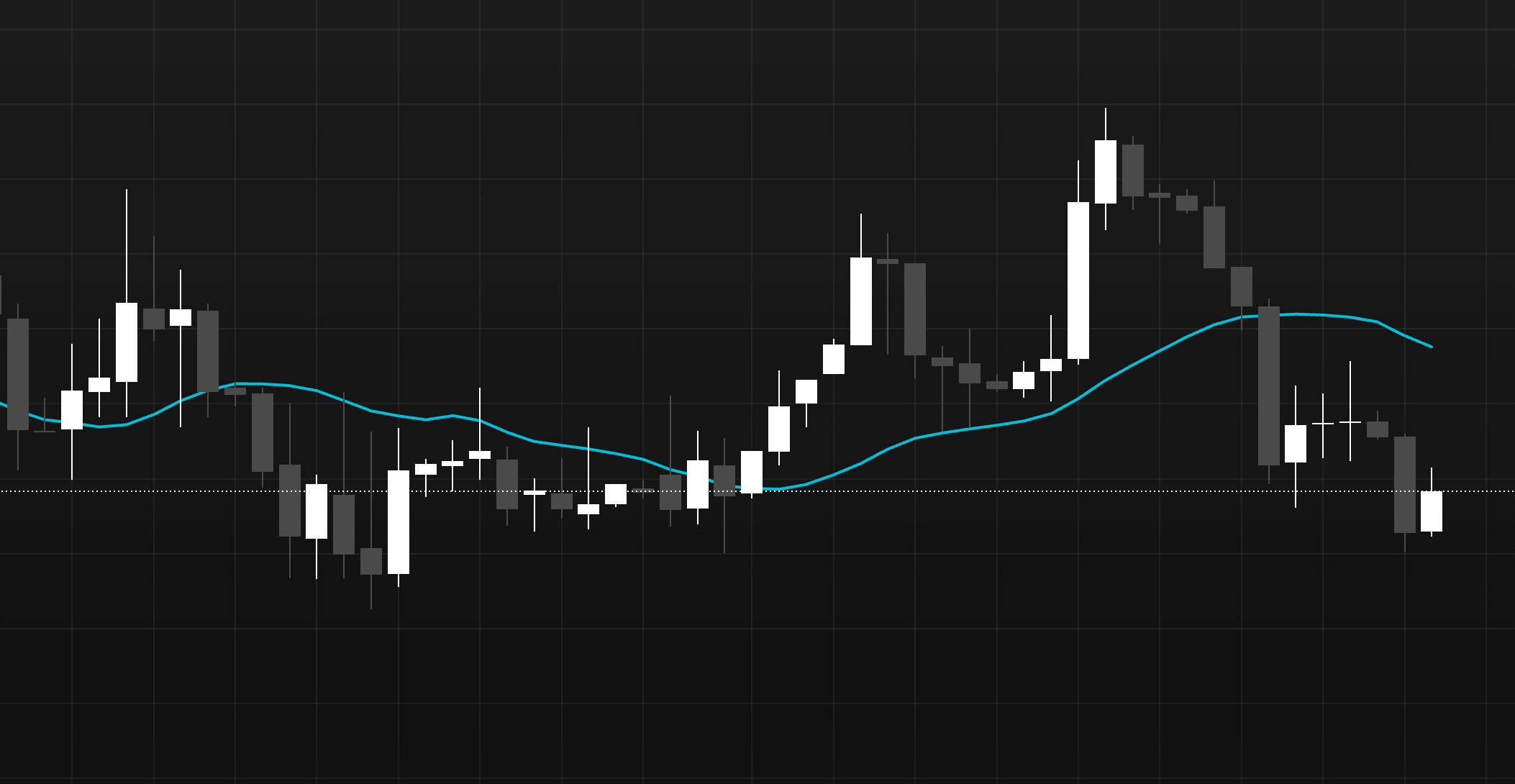

EMA – Exponential Moving Average

A moving average that reacts faster to recent price changes.

- What it measures: Short-term trend shifts

- When to use it: Fast-moving or volatile markets

- Why it’s useful: Responds quicker than SMA to momentum changes

- Default Period: 9

Example:

“Sell when the 9-period EMA crosses below the 21-period EMA.”

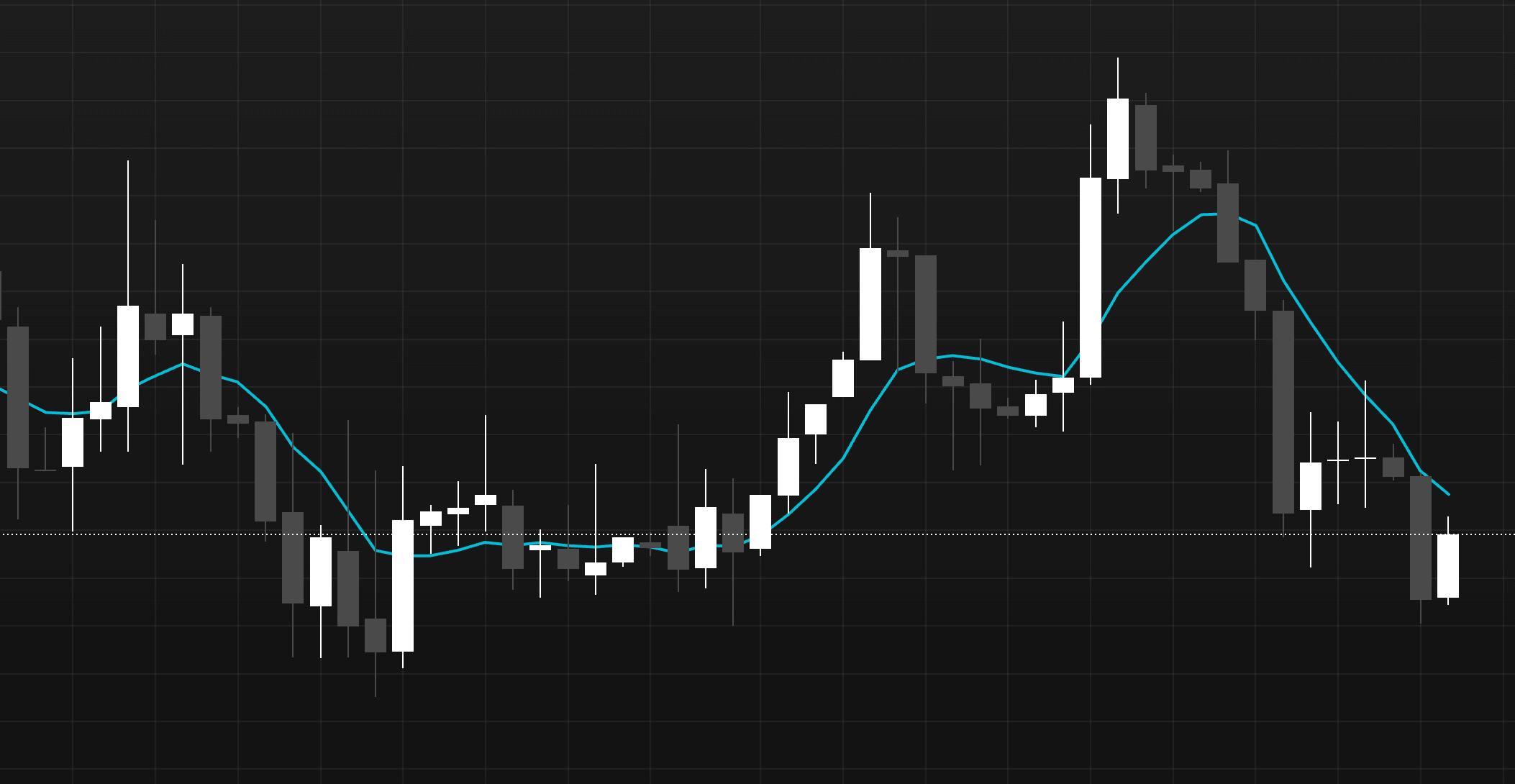

WMA – Weighted Moving Average

Applies increasing weight to more recent prices.

- What it measures: Trend with emphasis on recent data

- When to use it: When responsiveness matters but noise should remain controlled

- Why it’s useful: Balanced alternative between SMA and EMA

- Default Period: 9

Example:

“Buy when price crosses above WMA.”

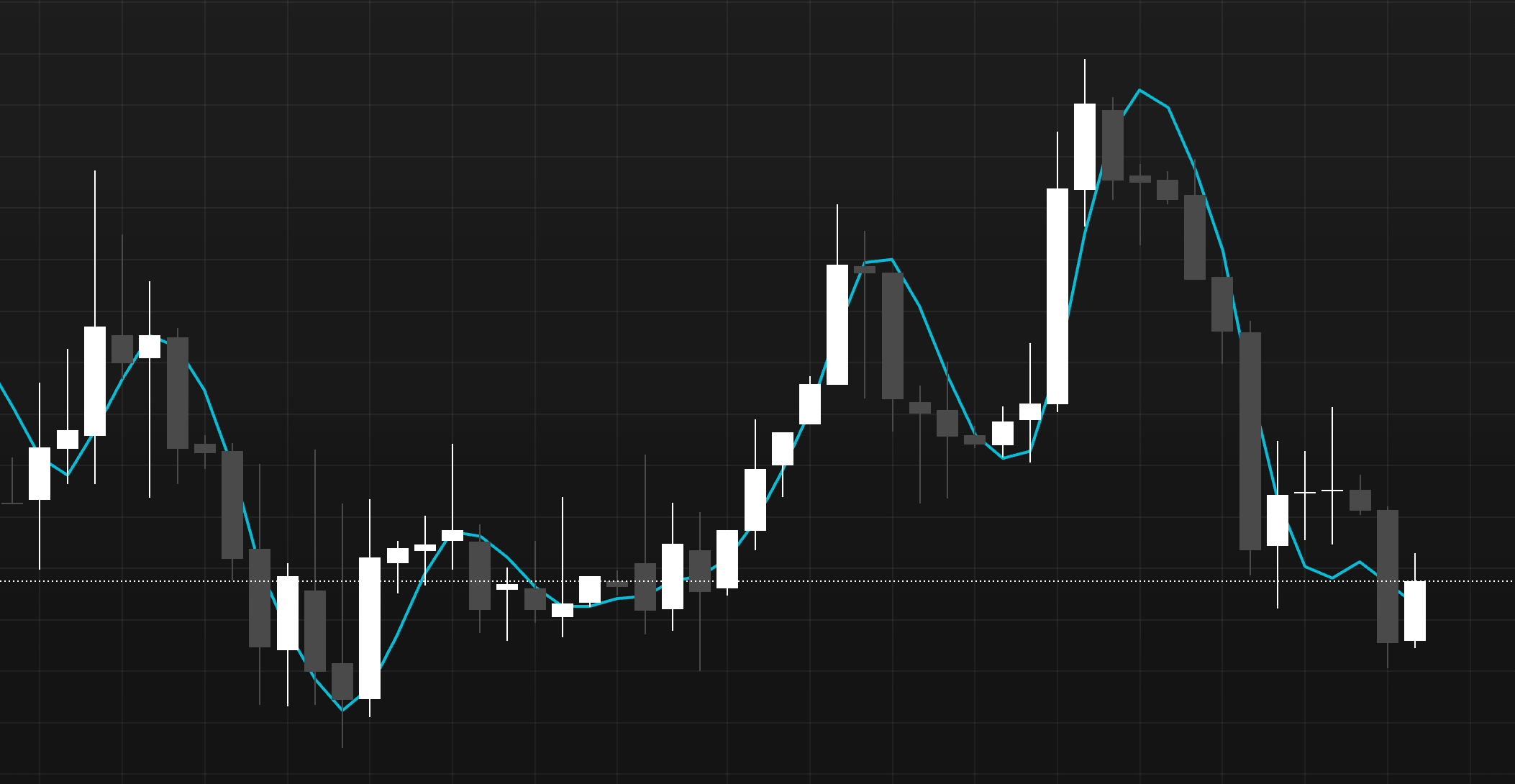

HMA – Hull Moving Average

Designed to reduce lag while maintaining smoothness.

- What it measures: Fast trend changes

- When to use it: Trend-following strategies requiring quick signals

- Why it’s useful: Faster response with less noise

- Default Period: 21

Example:

“Enter long when HMA turns upward.”

DEMA – Double Exponential Moving Average

Applies double smoothing to reduce lag further.

- What it measures: Momentum-driven trends

- When to use it: Rapid price movements

- Why it’s useful: Very responsive trend signals

- Default Period: 20

Example:

“Buy when DEMA crosses above price.”

RMA – Running Moving Average

A smoothed moving average commonly used in RSI calculations.

- What it measures: Smoothed price or indicator trends

- When to use it: Reducing noise in oscillators

- Why it’s useful: Stable smoothing without sharp jumps

- Default Period: 14

Example:

“Use RMA to smooth RSI signals.”

ER – Efficiency Ratio

Measures how efficiently price is trending.

- What it measures: Trend quality vs noise

- When to use it: Filtering choppy markets

- Why it’s useful: Avoids low-quality trends

- Default Period: 10

Example:

“Trade only when ER is above 0.5.”

DM – Directional Movement

Compares upward and downward price movement.

- What it measures: Directional dominance

- When to use it: Confirming trend direction

- Why it’s useful: Helps avoid false breakouts

- Default Period: 14

Example:

“Enter long when +DM exceeds –DM.”

VIDYA – Variable Index Dynamic Average

Adapts smoothing based on trend efficiency.

- What it measures: Trend strength with volatility awareness

- When to use it: Markets with changing volatility

- Why it’s useful: Automatically adapts to market conditions

- Default Period: 14

Example:

“Enter long when VIDYA slope turns positive.”

AROON – Aroon Up/Down

Tracks time since recent highs and lows.

- What it measures: Trend emergence and strength

- When to use it: Early trend detection

- Why it’s useful: Identifies trend transitions

- Default Period: 14

Example:

“Buy when Aroon Up crosses above Aroon Down.”

AMA – Adaptive Moving Average

An adaptive moving average that adjusts its sensitivity based on market behavior.

- What it measures: Trend direction while adapting to volatility

- When to use it: Markets that alternate between ranging and trending

- Why it’s useful: Reduces noise in sideways markets while remaining responsive in trends

- Default Period: 10

Example:

“Enter long when price crosses above AMA.”

ST – Supertrend

Trend-following indicator based on price and volatility.

- What it measures: Trend direction

- When to use it: Trend confirmation and trade direction

- Why it’s useful: Clear visual trend and stop guidance

- Defaults: ATR Period 10, Multiplier 3

Example:“Buy when price closes above the Supertrend line.”

2. Momentum Indicators

RSI – Relative Strength Index

RSI – Relative Strength Index

Measures momentum and identifies overbought or oversold levels.

- What it measures: Strength of recent price moves

- When to use it: Reversals and momentum shifts

- Why it’s useful: Clear overbought/oversold signals

- Default Period: 14

Example:

“Buy when RSI crosses below 30."

CCI – Commodity Channel Index

Measures deviation from average price.

- What it measures: Overbought/oversold extremes

- When to use it: Breakouts and reversals

- Why it’s useful: Identifies strong price deviations

- Default Period: 20

Example:

“Sell when CCI drops below +100.”

CMO – Chande Momentum Oscillator

Quantifies directional momentum.

- What it measures: Net buying vs selling pressure

- When to use it: Momentum confirmation

- Why it’s useful: Clear directional bias

- Default Period: 20

Example:

“Enter long when CMO is above 50.”

ROC – Rate of Change

Measures percentage price change over time.

- What it measures: Momentum acceleration

- When to use it: Early momentum shifts

- Why it’s useful: Simple momentum detection

- Default Period: 9

Example:

“Buy when ROC rises above zero.”

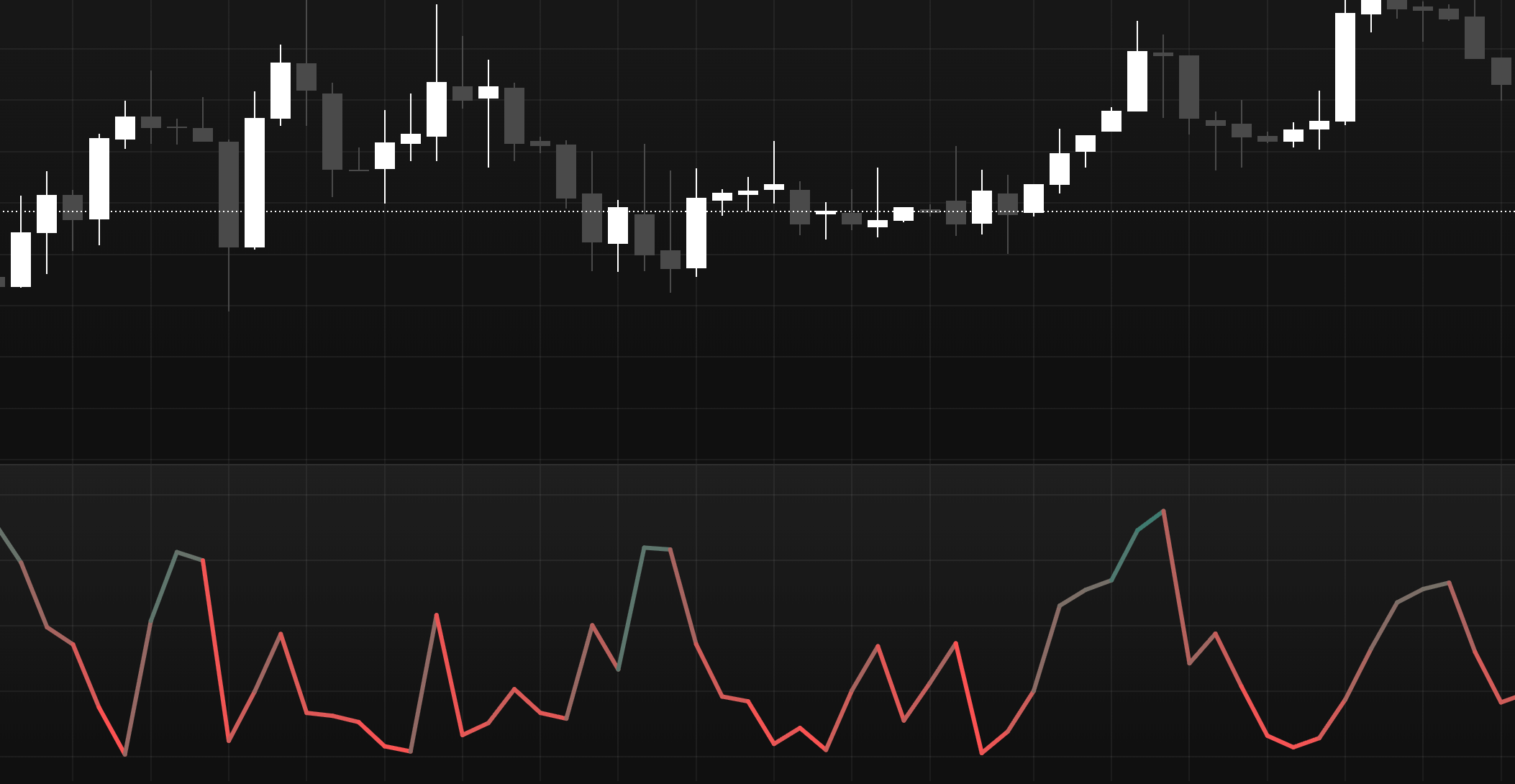

MACD – Moving Average Convergence Divergence

Measures momentum by comparing fast and slow moving averages.

- What it measures: Momentum and trend shifts

- When to use it: Trend confirmation and reversals

- Why it’s useful: Combines trend and momentum in one indicator

- Defaults: Fast 12, Slow 26, Signal 9

Example:

“Buy when MACD crosses above Signal.”

STOCH – Stochastic Oscillator

Compares closing price to its recent range.

- What it measures: Momentum relative to range

- When to use it: Short-term reversals

- Why it’s useful: Effective in ranging markets

- Defaults: %K 14, %D 3

Example:

“Buy when %K crosses above %D below 20.”

MFI – Money Flow Index

Measures buying and selling pressure using price and volume.

- What it measures: Momentum and volume strength

- When to use it: Overbought/oversold conditions and reversals

- Why it’s useful: Confirms momentum with volume (not just price)

- Default Period: 14

Example:“Buy when MFI rises above 20 after being oversold.”

3. Volatility Indicators

ATR – Average True Range

Measures average price range.

- What it measures: Volatility

- When to use it: Stop placement and position sizing

- Why it’s useful: Adapts risk to market conditions

- Default Period: 14

Example:

“Set stop loss 1.5× ATR below entry.”

BB – Bollinger Bands

Volatility bands around a moving average.

- What it measures: Volatility expansion and contraction

- When to use it: Breakouts and mean reversion

- Why it’s useful: Visual volatility context

- Defaults: 20 periods, 2 standard deviations

Example:

“Buy when price closes above the upper band.”

KC – Keltner Channel

Volatility channels based on EMA and ATR.

- What it measures: Trend-based volatility

- When to use it: Trend continuation strategies

- Why it’s useful: Smoother than Bollinger Bands

Example:

“Buy when price breaks above the upper channel.”

KP – Keltner Position

Shows where price sits within Keltner Channels.

- What it measures: Price position

- When to use it: Overextension detection

- Why it’s useful: Contextual channel positioning

Example:

“Sell when price is near the upper boundary.”

DC – Donchian Channel

Tracks highest highs and lowest lows.

- What it measures: Breakout levels

- When to use it: Trend breakout strategies

- Why it’s useful: Clear support and resistance

Example:

“Enter long when price breaks above the upper channel.”

VHF – Vertical Horizontal Filter

Determines if a market is trending or ranging.

- What it measures: Trend strength

- When to use it: Strategy filtering

- Why it’s useful: Avoids range-bound conditions

Example:

“Trade trends only when VHF is above 0.5.”

4. Volume Indicators

OBV – On-Balance Volume

Tracks cumulative volume flow.

- What it measures: Volume confirmation

- When to use it: Trend validation

- Why it’s useful: Confirms price strength

Example:

“Enter long when OBV confirms new highs.”

VWAP – Volume Weighted Average Price

Volume-weighted average price.

- What it measures: Fair value

- When to use it: Mean reversion and trend bias

- Why it’s useful: Institutional benchmark

Example:

“Buy when price is below VWAP in an uptrend.”

KVO – Klinger Volume Oscillator

Measures volume-based momentum.

- What it measures: Volume trend changes

- When to use it: Trend reversals

- Why it’s useful: Volume-backed confirmation

Example:

“Buy when KVO crosses above its signal.”

PRESSURE – Volume Pressure Index

Measures buying vs selling pressure.

- What it measures: Accumulation and distribution

- When to use it: Early trend signals

- Why it’s useful: Detects hidden pressure

Example:

“Enter long when buying pressure increases.”

VR – Volatility Ratio

Compares short-term and long-term volatility.

- What it measures: Volatility shifts

- When to use it: Timing breakouts

- Why it’s useful: Identifies volatility expansion

Example:

“Trade when VR exceeds 1.2.”

RVI – Relative Volatility Index

RSI-style volatility indicator.

- What it measures: Volatility momentum

- When to use it: Volatility extremes

- Why it’s useful: Complements RSI

Example:

“Sell when RVI exceeds 70.”

5. Other Indicators

SWINGS – Swing Points Detector

Identifies local highs and lows.

- What it measures: Market turning points

- When to use it: Swing trading

- Why it’s useful: Clear structure definition

- Default Lookback: 5

Example:

“Enter long at confirmed swing low.”

LINREG – Linear Regression

Fits a regression line to price data.

- What it measures: Trend direction and strength

- When to use it: Trend-following strategies

- Why it’s useful: Objective trend estimation

- Default Period: 100

Example:

“Enter long when price crosses above the regression line.”